Know Your Investor (May Edition): Alexandria Venture Investment

Shots:

- In the May Edition of the Know Your Investor series, we are focussing on Alexandria Venture Investments, an integral part of Alexandria Real Estate Equities

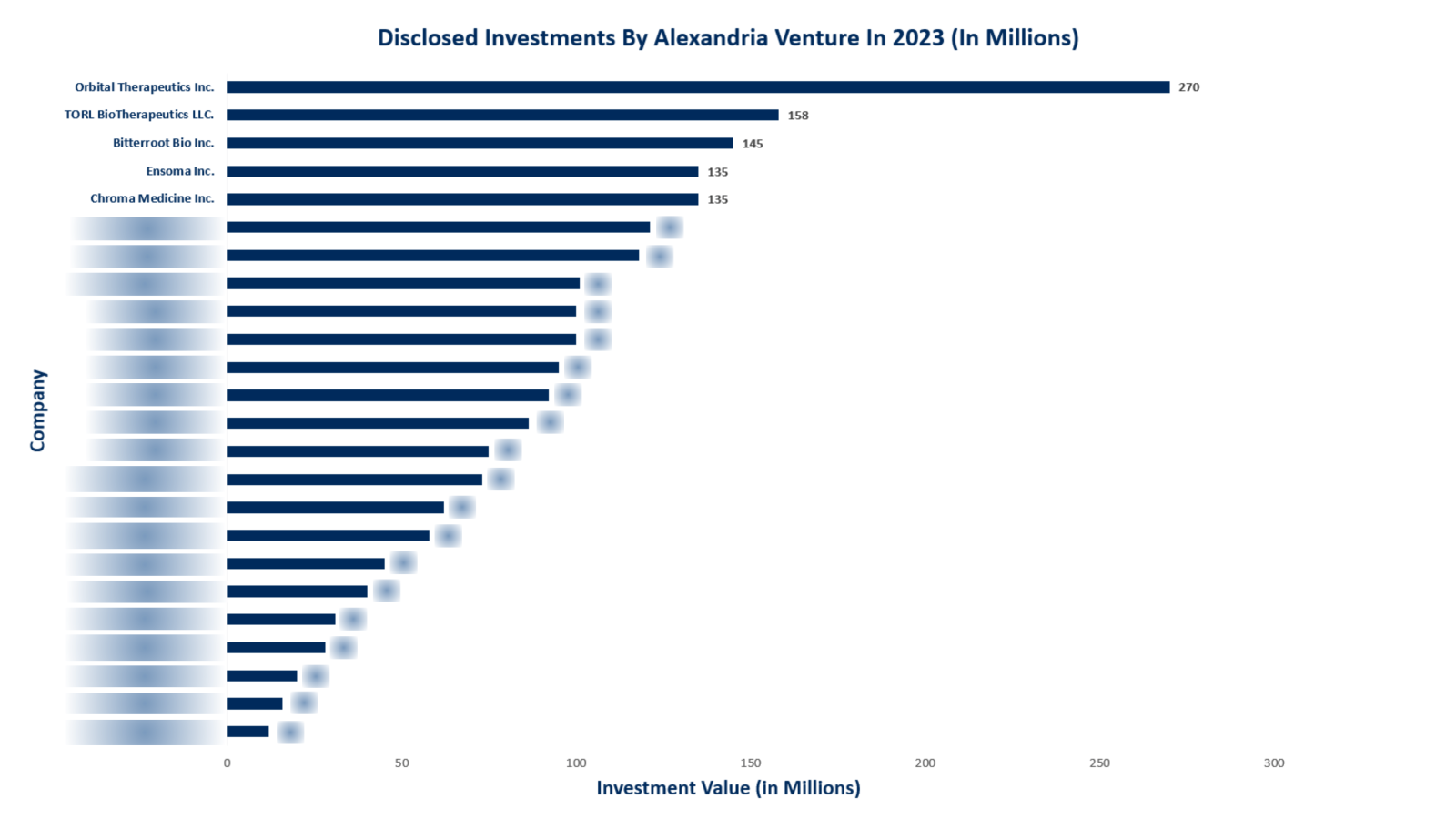

- In 2023, Alexandria Venture Investments invested in 24 companies; 5, 8, 5 & 6 every quarter across 2023 respectively

- For a detailed report on all the investments, reach out to us at connect@pharmashots.com

Alexandria Venture Investments

Founded in 1996, Alexandria Venture Investments is an integral part of Alexandria Real Estate Equities, a real estate investment firm based in California, United States. The company was named after the city of Alexandria, Egypt, known as the scientific capital of the ancient world, and its relationship with scientific advancements and revolutionary discoveries. Alexandria Venture Investment is a venture capital arm of Alexandria Real Estate Equities that solely invests in life science firms.

In 2023, Alexandria mainly invested in Series A, Series B, and Series C rounds followed by Seed, PIPE, and one private investment. The funding made to companies involved technologies like Antibody, Artificial Intelligence (AI) / Machine Learning (ML), Cell Therapy, DNA, Gene Editing/CRISPR, Gene Therapy, Genomics, Immunotherapy, Protein, RNA, Small Molecule, and stem cell. Moma Therapeutics, Ventus Therapeutics, Capstan Therapeutics, Creyon Bio, and Remix Therapeutics, among others, are part of Alexandria Venture’s portfolio companies. In 2023, Orbital Therapeutics Inc. received the highest funding worth $ 270M.

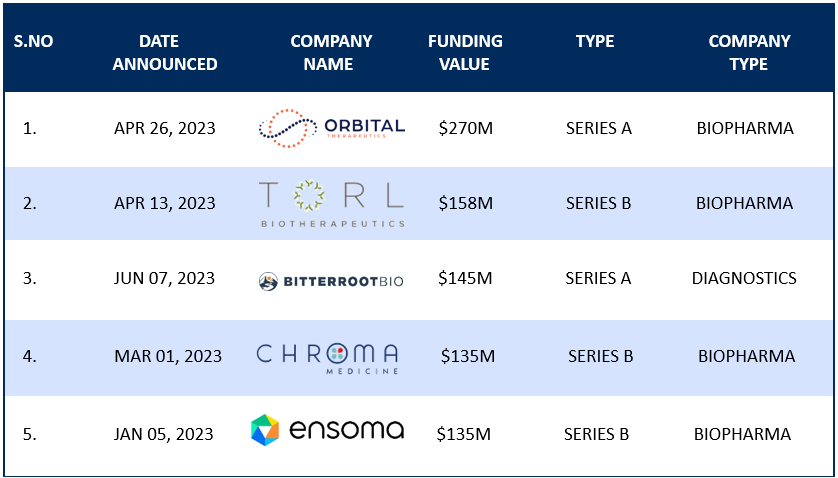

In 2023, Alexandria made 24 investments. A significant amount of these investments was made to biopharmaceutical companies, manufacturing, and service providers with a focus on Oncology, Autoimmune, Cardiovascular, Gastrointestinal, Hematologic, Inflammation, and Neurologic. In 2023, 33.3% of Alexandria Venture’s total investments were made under Series B, whereas 29.1% accounted for Series A. Alexandria Venture’s top 3 investments for 2022 are as follows:

- Series A funding worth $270M to Orbital Therapeutics Inc.

- Series B funding worth $158M to TORL BioTherapeutics LLC.

- Series A funding worth $145M to Bitterroot Bio Inc.

In 2023, Alexandria Venture participated in a total of six funding rounds; by investing in 5 companies in the first quarter, eight in the second, five in the third, and six in the fourth quarters respectively. Amongst the Biopharma companies, the list also includes Tome Biosciences Inc., Ability Biologics Inc., and Odyssey Therapeutics Inc. Under Manufacturing or Service providers, Alexandria Venture invested in Function Oncology Inc. and Chroma Medicine Inc.

Alexandria Venture invested heavily in companies developing therapies associated with antibodies in terms of technology. TORL BioTherapeutics LLC. received a total of $158M from Alexandria Venture, while Triveni Bio, Georgiamune, and Arialys Therapeutics, received $58M, $75M, and $58M respectively

The following table represents the top 5 out of the 24 investments made by Alexandria Venture Investments in 2023.

Note: (For a complete report, reach out to us at connect@pharmashots.com with the subject line "Alexandria Venture Investments Data" or for early access to complete data for future reports and analysis register here: https://forms.office.com/r/VwFu6aUm80)

Related Post: Know Your Investor: Alexandria Venture Investments

Tags

An avid reader and a dedicated learner, Prince works as a Content Writer at PharmaShots. Prince possesses an exceptional quality of breaking down the barriers of words by simplifying the terms in digestible chunks to make content readable and comprehensible. Prince likes to read books and loves to spend his free time learning and upskilling himself.